if you say "flat tax" youre either a rich starfish piece of stuff or completely uninformed and ignorant about how taxes work

The second possibility of your statement doesn't make any sense. The question isn't "Do we use a Flat or Progressive Income Tax?" so promoting a different tax system doesn't imply or express that you don't understand how a progressive tax system (i.e. the US Tax Code) works. Furthermore, wealth-shaming is disgusting. Being "rich" doesn't make you an starfish or a piece of stuff. You don't need to be Mormon and donate 98% of your income to charity to fend off the title of "rich starfish prick." Nobody is advocating for a static tax that everyone pays. Obviously in any tax system the rich are going to pay more taxes, that's why tax systems use percentages of income. Rich people earn more money, so even while the percentage is the same the raw amount of currency taxed from the rich is higher. It's plain unfair to tell people that their fair share of taxes is more just because they make more money. The government is a raging behemoth and shouldn't use nearly as much money as it does.

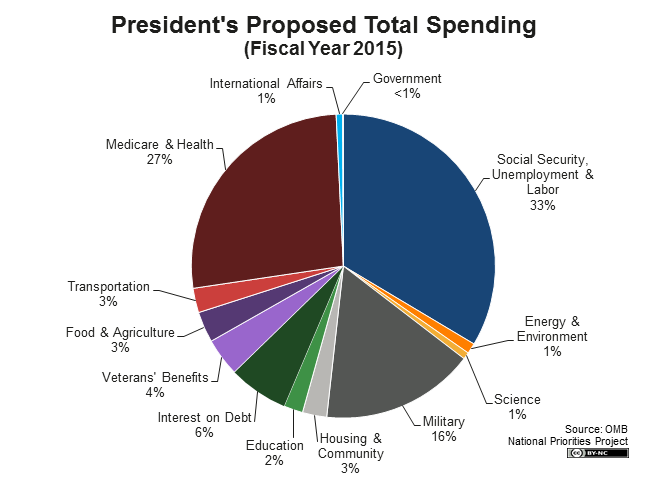

Look at how much of the pie is taken up by entitlement programs: more than 60%. More than 50% of all spending goes to medicare and health, social security, unemployment, and labor. Sixty percent of all of our spending goes to entitlement programs. Let that sink in. People are saying to cut military spending because it's so egregiously large; that's a meek 16% compared to entitlement programs. Not to mention, the interest on debt we pay is the fourth largest individual pie piece. We pay more on debt than we do on energy and environment, science, housing and community combined.

We straight up can't afford this. Progressive or flat tax system, we spend significantly more money than we make. To begin with Social Security needs to be tapered off and cut. It's terrible that we have to forget over people who've been paying into it their whole lives, but they really got forgeted over by poor legislation. As more of the baby boomers move into the age range for social security collection, the strain it puts on us increases. The program was instituted at a time where the ratio of old:young was lower. I have no personal gripes with unemployment, I'm not a crazy republican who claims that people don't get jobs because their unemployment check is good enough. I have gripes with medicare and health though, look how much loving money that costs. It's absurd. We could cut ALL transportation, food and agriculture, veterans benefits, education, housing and community, science, energy and environment, and international affairs and we'd free up less of the budget than cutting medicare and health. That's ridiculous. We can't afford it.

TL;DR: Cutting entitlement programs would decrease the amount of money the government needs to spend which would open us up to the possibilities of using a flat tax because a government that needs less money doesn't need to strangulate the upper end of the income of the wealthy just to survive.